- Joined

- Apr 17, 2018

- Messages

- 24,659

Analyzing Your PopAds Campaigns using BeMob

As I mentioned earlier, I do not expect this campaign to be profitable within our $10 budget. Very rarely will you be profitable with your initial testing. Instead, the initial testing phase of an affiliate marketing campaign is specifically to gather data on how an audience performs with a particular affiliate offer.

Your goal for your initial testing of an affiliate campaign is to simply get conversions. Without conversions, our data is basically just telling us “this is not going to work.”

Once you have some conversions, your data is now telling you “this has some potential.”

This campaign is designed to get you conversions so we have some data we can truly analyze and optimize.

I am happy to say that is exactly what it did

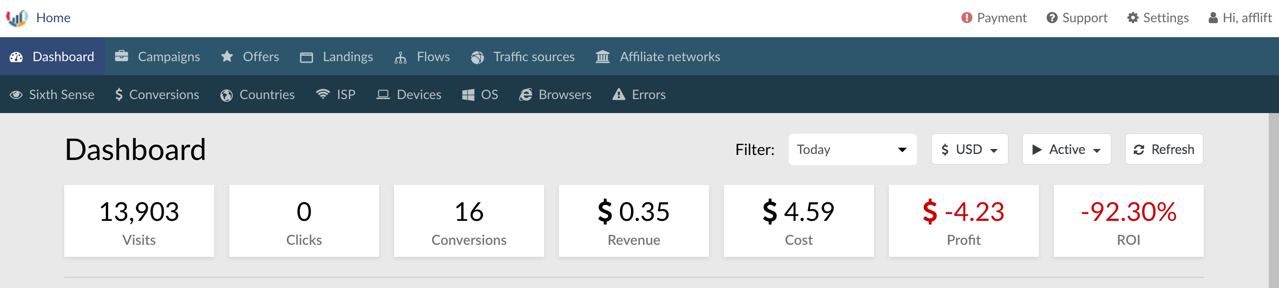

My BeMob dashboard shows that with my $5 spent (they only tracked $4.59), I got 16 conversions and made $0.35.

Now, I realize an ROI of -92.30% isn’t overly attractive, but we’ll break it down and see what the data actually tells us.

First though, I want to login to my MOBIPIUM account to make sure they’re also showing 16 conversions.

Something to keep in mind: your tracker, traffic source, and affiliate network may all be on different time zones. This can cause your reports to not match up perfectly, but in most cases, you can set the time zones to whatever you want.

MOBIPIUM uses Lisbon’s time zone (GMT), PopAds lets you set the time zone when you run a report, and you can update the time zone your BeMob tracker uses by going to Settings, Tracker, and time zone is at the top:

UTC and GMT are the same thing (they’re on the same time zone).

Anyway, when I login to my MOBIPIUM account, I can see that my conversions match, but there was some click loss:

Click loss is common with pop traffic. It basically means that a percent of our clicks are not going to track and get “lost” because the link never finished loading. With pops, this happens a lot when the user exits the pop-up before the landing page loads.

While I love BeMob and their awesome free plan for their tracker, you will see less click loss with a faster tracker (you get what you pay for). But, for what we are trying to do, this is not a big deal.

Breaking down your campaign

We want to run a report for our campaign so we can break it down and see what is working and what is not working. Then, we will make changes according to what the data tells us and spend our last $5 on a more optimize campaign.

In BeMob, click on Campaigns, your campaign name, and then the Report button:

The default report is the one I wanted to look at first, our Offers. But, before we dig into it, let’s remove the columns in BeMob that we do not need so we can more easily analyze what we’re seeing.

Click on the Columns button and we’ll remove a bunch of them that we do not need:

I’m removing:

Once you remove all of those, you will notice that your reports are much easier to read. Now, let’s take a look at how our offers were were split testing performed:

They actually performed pretty evenly. Our top converter was Push_Smart_5 at 0.18%. You’ll notice the average payout (AP) is different for each offer. This is because the smartlink pays differently based on whatever country is converting. So, with Push_Smart_5, the conversion rate was the best, but the average payout wasn’t. With this campaign, we should be mainly focused on the conversion rate. We’ll find the offer that converts best and then run it on the countries that are converting best overall.

So, let’s also take a look at Countries:

Immediately, this report tells me a lot. If you take a look at the top 2 countries listed (sort by Visits by default), you’ll see:

So, we spent nearly half our budget on 2 countries without a conversion. Believe it or not, this is actually a good thing. That means we must have some other countries in our list that have some potential!

If you click on the ROI column header, it’ll sort the data based on ROI:

These results are interesting. We were profitable in Germany and Sweden without hardly any traffic. South Korea and Thailand also seem to have some potential. Italy, Brazil, and Turkey also all had conversions, but we’ve got a long way to go before we’re going to get those profitable.

One thing to keep in mind with the MOBIPIUM smartlink is that the payouts will vary based on performance. So, ideally, we’d start generating a lot of volume in the GEOs that are close to profitable, do some optimizations, and then we’d also see an increase in payout from MOBIPIUM when our traffic performs well for them. A better strategy would probably be to find more stable sources for higher payouts for these types of offers if you wanted to scale.

Something else to keep in mind is that there are A LOT of countries that we hardly got any traffic in. So, because our initial test was with a low $5 budget, we’re probably missing out on some data.

So far, we’ve analyzed 2 segments of this campaign:

The traffic source variables are the ones that are automatically tracked by BeMob when we setup the traffic source template earlier.

With PopAds, those are:

I call these traffic source variables because these are unique to the traffic source you are working with.

We will be able to analyze and optimize the countries and offers we are promoting on any campaign on any traffic source, but we’re only going to be able to analyze the PopAds WebsiteID on a PopAds campaign.

With PopAds, the two main variables I typically analyze for are:

The CategoryID is the category the website falls within. Remember, earlier we removed all the Adult categories. You’ll find some categories perform better than others for specific types of offers as well.

So, let’s take a look at those two things. Let’s start with the WebsiteID (my favorite):

The BeMob reports for the custom traffic source variables are under the Custom button in the menu:

Again, as soon as I open the WebsiteID report, I see some interesting data. The top 3 websites in traffic volume did not convert at all:

Let’s find the WebsiteIDs for the websites we did have conversions from. This is a fun report that you should use a lot.

Click on the icon next to Conv. and choose > and click Apply:

This report shows that we had 6 profitable WebsiteIDs (that should increase as we do our other optimizations) and if you only include the WebsiteIDs that had conversions, our ROI was only -22%.

Learning to run reports like this can be very powerful. There is a lot you can do within BeMob with this type of reporting.

For example, let’s say I wanted to know what countries I was getting conversions from for these WebsiteIDs. When I run that report, I see that I have website that is producing 150% ROI in South Korea:

Your initial campaigns are NOT going to be profitable. How do you get your campaigns profitable? You analyze your data just like this.

Before we optimize our campaign, let’s take a look at the CategoryID report we talked about earlier:

There is not a whole lot of data here for us to make any changes from and since I already have some changes planned, I am not going to make any changes to the campaign categories.

You don’t want to over optimize your campaign. When you make changes, do them slowly. We need to know how removing a lot of GEOs is going to impact our campaign. If we remove GEOs and Categories, then how do we know which change is positively impacting the campaign?

Based on the data we’ve seen, we should spend our last $5 on this campaign (before we fund it with more money, hopefully) testing specific countries we’re seeing some early results in.

Let’s go back to the Countries report and sort by EPV:

Our PopAds CPV is $0.0003 ($0.33 CPM). 4 of the 5 countries shown have an EPV pretty close to our CPV. We should be able to drive more traffic to those countries and collect more data and be almost breakeven or profitable. I want to include Italy as well since we got a nice amount of traffic from Italy and 2 conversions, but our EPV on it is probably too low. Also, based on the volume of traffic we received (about 10% of our total budget), we can probably decrease our CPM in PopAds for Italy and collect more data and potentially get it profitable at a $0.20 CPM instead of $0.33 we’re paying right now.

So, let’s go back to PopAds and optimize our campaign by removing all countries except:

NEXT: Step 11 - Optimizing our campaign

As I mentioned earlier, I do not expect this campaign to be profitable within our $10 budget. Very rarely will you be profitable with your initial testing. Instead, the initial testing phase of an affiliate marketing campaign is specifically to gather data on how an audience performs with a particular affiliate offer.

Your goal for your initial testing of an affiliate campaign is to simply get conversions. Without conversions, our data is basically just telling us “this is not going to work.”

Once you have some conversions, your data is now telling you “this has some potential.”

This campaign is designed to get you conversions so we have some data we can truly analyze and optimize.

I am happy to say that is exactly what it did

My BeMob dashboard shows that with my $5 spent (they only tracked $4.59), I got 16 conversions and made $0.35.

Now, I realize an ROI of -92.30% isn’t overly attractive, but we’ll break it down and see what the data actually tells us.

First though, I want to login to my MOBIPIUM account to make sure they’re also showing 16 conversions.

Something to keep in mind: your tracker, traffic source, and affiliate network may all be on different time zones. This can cause your reports to not match up perfectly, but in most cases, you can set the time zones to whatever you want.

MOBIPIUM uses Lisbon’s time zone (GMT), PopAds lets you set the time zone when you run a report, and you can update the time zone your BeMob tracker uses by going to Settings, Tracker, and time zone is at the top:

UTC and GMT are the same thing (they’re on the same time zone).

Anyway, when I login to my MOBIPIUM account, I can see that my conversions match, but there was some click loss:

Click loss is common with pop traffic. It basically means that a percent of our clicks are not going to track and get “lost” because the link never finished loading. With pops, this happens a lot when the user exits the pop-up before the landing page loads.

While I love BeMob and their awesome free plan for their tracker, you will see less click loss with a faster tracker (you get what you pay for). But, for what we are trying to do, this is not a big deal.

Breaking down your campaign

We want to run a report for our campaign so we can break it down and see what is working and what is not working. Then, we will make changes according to what the data tells us and spend our last $5 on a more optimize campaign.

In BeMob, click on Campaigns, your campaign name, and then the Report button:

The default report is the one I wanted to look at first, our Offers. But, before we dig into it, let’s remove the columns in BeMob that we do not need so we can more easily analyze what we’re seeing.

Click on the Columns button and we’ll remove a bunch of them that we do not need:

I’m removing:

- Clicks

- Uniq. Clicks

- CPC

- CTR

- UCTR

- CR

- EPC

Once you remove all of those, you will notice that your reports are much easier to read. Now, let’s take a look at how our offers were were split testing performed:

They actually performed pretty evenly. Our top converter was Push_Smart_5 at 0.18%. You’ll notice the average payout (AP) is different for each offer. This is because the smartlink pays differently based on whatever country is converting. So, with Push_Smart_5, the conversion rate was the best, but the average payout wasn’t. With this campaign, we should be mainly focused on the conversion rate. We’ll find the offer that converts best and then run it on the countries that are converting best overall.

So, let’s also take a look at Countries:

Immediately, this report tells me a lot. If you take a look at the top 2 countries listed (sort by Visits by default), you’ll see:

- India

- Indonesia

So, we spent nearly half our budget on 2 countries without a conversion. Believe it or not, this is actually a good thing. That means we must have some other countries in our list that have some potential!

If you click on the ROI column header, it’ll sort the data based on ROI:

These results are interesting. We were profitable in Germany and Sweden without hardly any traffic. South Korea and Thailand also seem to have some potential. Italy, Brazil, and Turkey also all had conversions, but we’ve got a long way to go before we’re going to get those profitable.

One thing to keep in mind with the MOBIPIUM smartlink is that the payouts will vary based on performance. So, ideally, we’d start generating a lot of volume in the GEOs that are close to profitable, do some optimizations, and then we’d also see an increase in payout from MOBIPIUM when our traffic performs well for them. A better strategy would probably be to find more stable sources for higher payouts for these types of offers if you wanted to scale.

Something else to keep in mind is that there are A LOT of countries that we hardly got any traffic in. So, because our initial test was with a low $5 budget, we’re probably missing out on some data.

So far, we’ve analyzed 2 segments of this campaign:

- Offers

- Countries

The traffic source variables are the ones that are automatically tracked by BeMob when we setup the traffic source template earlier.

With PopAds, those are:

I call these traffic source variables because these are unique to the traffic source you are working with.

We will be able to analyze and optimize the countries and offers we are promoting on any campaign on any traffic source, but we’re only going to be able to analyze the PopAds WebsiteID on a PopAds campaign.

With PopAds, the two main variables I typically analyze for are:

- WebsiteID

- CategoryID

The CategoryID is the category the website falls within. Remember, earlier we removed all the Adult categories. You’ll find some categories perform better than others for specific types of offers as well.

So, let’s take a look at those two things. Let’s start with the WebsiteID (my favorite):

The BeMob reports for the custom traffic source variables are under the Custom button in the menu:

Again, as soon as I open the WebsiteID report, I see some interesting data. The top 3 websites in traffic volume did not convert at all:

Let’s find the WebsiteIDs for the websites we did have conversions from. This is a fun report that you should use a lot.

Click on the icon next to Conv. and choose > and click Apply:

This report shows that we had 6 profitable WebsiteIDs (that should increase as we do our other optimizations) and if you only include the WebsiteIDs that had conversions, our ROI was only -22%.

Learning to run reports like this can be very powerful. There is a lot you can do within BeMob with this type of reporting.

For example, let’s say I wanted to know what countries I was getting conversions from for these WebsiteIDs. When I run that report, I see that I have website that is producing 150% ROI in South Korea:

Your initial campaigns are NOT going to be profitable. How do you get your campaigns profitable? You analyze your data just like this.

Before we optimize our campaign, let’s take a look at the CategoryID report we talked about earlier:

There is not a whole lot of data here for us to make any changes from and since I already have some changes planned, I am not going to make any changes to the campaign categories.

You don’t want to over optimize your campaign. When you make changes, do them slowly. We need to know how removing a lot of GEOs is going to impact our campaign. If we remove GEOs and Categories, then how do we know which change is positively impacting the campaign?

Based on the data we’ve seen, we should spend our last $5 on this campaign (before we fund it with more money, hopefully) testing specific countries we’re seeing some early results in.

Let’s go back to the Countries report and sort by EPV:

Our PopAds CPV is $0.0003 ($0.33 CPM). 4 of the 5 countries shown have an EPV pretty close to our CPV. We should be able to drive more traffic to those countries and collect more data and be almost breakeven or profitable. I want to include Italy as well since we got a nice amount of traffic from Italy and 2 conversions, but our EPV on it is probably too low. Also, based on the volume of traffic we received (about 10% of our total budget), we can probably decrease our CPM in PopAds for Italy and collect more data and potentially get it profitable at a $0.20 CPM instead of $0.33 we’re paying right now.

So, let’s go back to PopAds and optimize our campaign by removing all countries except:

- Germany

- Sweden

- South Korea

- Thailand

NEXT: Step 11 - Optimizing our campaign

Last edited: